Texas title loans for college students provide fast cash secured by a vehicle, but carry higher interest rates than traditional personal loans. To apply, students must be 18+, have valid ID, own a car free of liens, and demonstrate repayment capability. Research lenders, compare rates and reviews, gather essential documents, and plan for repayment to increase approval chances.

“Texas title loans for college students can provide a much-needed financial boost during your academic journey. This guide delves into the intricacies of these loans, designed specifically to cater to the financial needs of students in Texas. Understanding the eligibility criteria is crucial before applying, as it varies based on factors like student status and vehicle ownership.

This comprehensive step-by-step process will walk you through securing a Texas title loan, ensuring an informed and successful application.”

- Understanding Texas Title Loans for College Students

- Eligibility Criteria: What You Need to Know

- Applying Step-by-Step: A College Student's Guide

Understanding Texas Title Loans for College Students

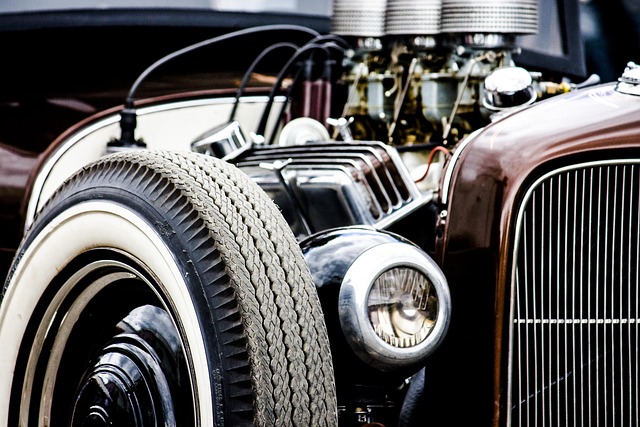

Texas title loans for college students are a form of secured lending that uses a student’s vehicle as collateral. This type of loan is designed to help finance educational expenses, such as tuition, books, and housing. Unlike traditional bank loans, Texas title loans offer more flexible eligibility criteria, making them accessible to many students who may not qualify for other types of financial aid.

For college students considering a Texas title loan, it’s essential to understand the process and options available. These loans typically involve pledging your vehicle’s title with a lender in exchange for a cash advance. While this can provide quick funding, it’s crucial to explore all possibilities, including loan refinancing or alternative solutions like Car Title Loans or Title Pawn, to ensure you’re making the best decision for your financial needs and future prospects.

Eligibility Criteria: What You Need to Know

When considering a Texas title loan for college students, it’s important to understand the eligibility criteria before applying. To be eligible, borrowers must meet certain requirements set by lenders. Typically, this includes being at least 18 years old and having a valid driver’s license or state ID. Since these loans are secured against your vehicle, you’ll also need to own a car free and clear of any existing liens. This ensures the lender has first priority in case of default.

While fast cash is a significant draw for many students, it’s crucial to remember that Houston title loans, or any title loan, come with interest rates higher than traditional personal loans. The title loan process involves assessing your vehicle’s value and comparing it to the loan amount you need. Lenders will then determine if they can approve your request based on these factors, along with your ability to repay the loan according to the agreed-upon terms.

Applying Step-by-Step: A College Student's Guide

Applying for a Texas Title Loan as a college student is a straightforward process, designed to help fund your education and cover unexpected expenses. Here’s a step-by-step guide tailored specifically for students:

1. Research and Compare Lenders: Start by exploring different lenders offering Texas title loans for college students. Check their interest rates, loan terms, and any additional fees. Remember, transparent and competitive rates can save you money in the long run. Look for online reviews to gauge the reliability of each lender.

2. Gather Necessary Documents: Before applying, ensure you have all required documents ready. These typically include a valid government-issued ID, proof of enrollment in a Texas college or university, and a clear vehicle title (in your name). For semi-truck loans, additional documentation related to the vehicle might be needed. Keep your loan payoff goals in mind; having a plan for repayment demonstrates financial responsibility.

Applying for a Texas title loan for college students can be a quick solution for funding education expenses. By understanding the eligibility criteria and following a straightforward application process, you can access the financial support you need without delay. Remember that while this option offers benefits, it’s crucial to consider alternative financing methods and carefully evaluate your repayment capabilities to ensure a positive impact on your academic journey.