Texas title loans for college students require understanding state regulations and providing key docs like ID, enrollment verification, bank statements, clear vehicle title, and financial aid details. Lenders assess creditworthiness through IDs, enrollment, financial verification, and a credit check, determining loan terms based on vehicle condition, mileage, and market value, ensuring fair transactions.

“Navigating the financial aid landscape can be challenging for college students, but understanding Texas title loan requirements can offer a unique solution. This article guides you through the essential documents needed for a Texas title loan specifically tailored for students. From ‘Understanding Texas Title Loan Requirements for Students’ to ‘Verifying Eligibility,’ we break down the process step-by-step. Ensure you’re prepared with the right paperwork and increase your chances of securing funding for your education.”

- Understanding Texas Title Loan Requirements for Students

- Essential Documents for College Loan Application Process

- Verifying Eligibility: What to Expect During Review

Understanding Texas Title Loan Requirements for Students

When considering a Texas title loan for college students, understanding the state’s specific requirements is essential. This type of loan is a secured loan, using your vehicle as collateral, which can make it easier to access funds while studying. In Texas, lenders typically require a few key documents to process these loans. Students should expect to provide proof of identification, such as a valid driver’s license or state ID card. Additionally, institutions of higher learning may need to verify enrollment status and academic performance.

Loan terms for Texas title loans for college students can vary based on the lender and the student’s ability to repay. Lenders will assess factors like income, creditworthiness, and the value of the secured asset (in this case, the vehicle) to determine interest rates and repayment periods. Houston title loans, for instance, might offer flexible terms tailored to students’ financial needs while ensuring they have a clear understanding of the loan’s conditions before signing any agreements.

Essential Documents for College Loan Application Process

When applying for a Texas title loan for college students, having the right documents is crucial to streamline the loan approval process. Essential papers include valid identification such as a driver’s license or state ID card, proof of enrollment in an accredited educational institution, and recent bank statements to verify financial standing. Additionally, a clear vehicle title, demonstrating ownership, is indispensable for securing the loan.

College students should also be prepared to provide documentation related to their financial aid packages, any existing loans, and plans for repayment. These details help lenders assess the borrower’s ability to manage the loan, especially when considering potential loan extensions or adjustments to interest rates. Ensuring all required documents are in order can significantly impact the efficiency of the application process and overall loan terms.

Verifying Eligibility: What to Expect During Review

When applying for a Texas title loan for college students, verifying eligibility is a crucial step in the process. Lenders will review your application and supporting documents to ensure you meet the basic requirements. This typically includes checking your identification, proof of enrollment in an accredited educational institution, and verification of your financial situation. Expect a thorough examination of your credit history through a credit check, as lenders assess your creditworthiness. The good news is that even with less-than-perfect credit, many students find they can secure quick approval for these loans.

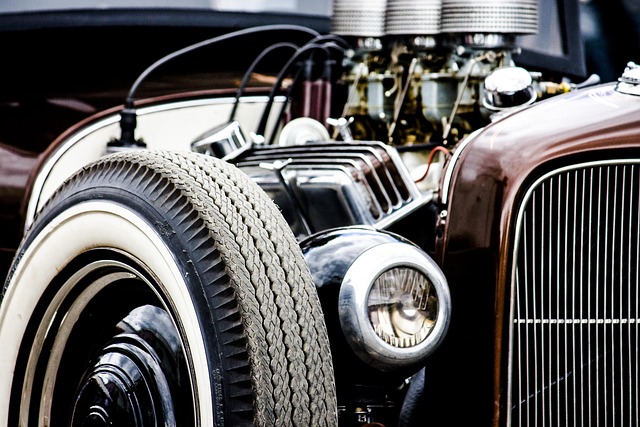

Houston title loans, like any other secured loan, rely on the value of an asset, in this case, your vehicle, to gauge your ability to repay. During the review process, lenders will appraise your vehicle’s condition and mileage to determine its worth. This appraisal plays a significant role in setting the loan amount you can qualify for. The goal is to ensure that the loan value aligns with the market value of your vehicle, providing a fair and secure transaction for both parties.

When pursuing a Texas title loan for college students, understanding the required documents and eligibility criteria is essential. By gathering all necessary paperwork, including identification, academic records, and financial statements, you’ll be well on your way to securing funding for your education. Remember, a thorough review process ensures that you meet the eligibility standards set by lenders, ultimately facilitating access to the financial support needed to thrive academically.