Texas title loans for college students offer quick cash using vehicle titles as collateral, but come with high interest rates and short repayment terms. Students should understand their rights, explore alternatives like grants and part-time work, compare lenders, and seek financial aid advice to avoid long-term debt.

In the competitive landscape of higher education, many college students turn to alternative financing options, including Texas title loans. This article delves into the intricacies of these short-term loans tailored to students, focusing on understanding consumer rights and navigating potential challenges. By exploring “Texas title loan for college students,” we aim to equip readers with knowledge to make informed decisions, ensuring they exercise their rights and protect themselves in this financial sector.

- Understanding Texas Title Loans for College Students

- Consumer Rights and Protections in Title Loan Agreements

- Navigating Challenges: A Guide for College Students

Understanding Texas Title Loans for College Students

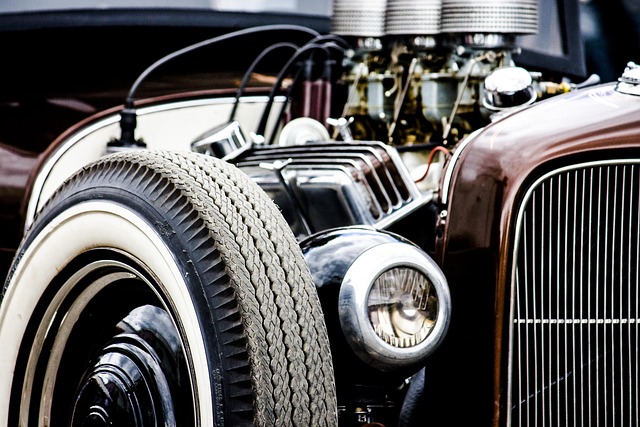

Texas title loans for college students are a type of secured lending that offers fast cash to those with a vehicle. In this case, students use their vehicle’s title as collateral. This option is popular among students due to its accessibility and potential benefits, such as helping with unexpected expenses or debt consolidation. It provides a quick solution for those in need of immediate financial assistance.

These loans are particularly appealing as they often have simpler eligibility requirements compared to traditional bank loans. Students can borrow money without needing an excellent credit score. However, it’s crucial to understand the terms and conditions thoroughly. While Texas title loans can offer fast cash, they typically come with higher interest rates and shorter repayment periods. Therefore, students should consider this option as a temporary solution for urgent financial needs and be prepared to pay back the loan promptly to avoid potential long-term debt, especially in comparison to other alternatives like truck title loans or fast cash from other sources.

Consumer Rights and Protections in Title Loan Agreements

When considering a Texas title loan for college students, it’s crucial to understand consumer rights and protections. These agreements can be complex, with various terms and conditions that might seem confusing or overwhelming. Students should remember that they are entitled to clarity and transparency from lenders. Disclosure of all fees, interest rates, and repayment terms is mandatory, allowing borrowers to make informed decisions.

Moreover, consumers have the right to cancel the loan agreement within a specified period, usually 72 hours, without any penalty. This cooling-off period offers an opportunity to change their minds or find alternative emergency funding sources. Additionally, Texas law provides safeguards against excessive interest rates and fees, ensuring that secured loans remain fair and manageable for students in need of immediate financial support, such as for tuition or living expenses.

Navigating Challenges: A Guide for College Students

Navigating financial challenges during college can be daunting, especially for students who might rely on quick funding solutions like Texas title loans for college students. These loans, secured against a student’s vehicle equity, offer a way to access financial assistance when traditional methods fall short. However, it’s crucial to understand the implications and alternatives before diving into such arrangements.

College students should explore various options first, including scholarships, grants, federal student loans, and part-time employment. If needing immediate funds, comparing lenders and understanding loan terms is essential. Quick funding can be enticing but may come with higher interest rates and fees. Knowing one’s rights as a consumer and seeking guidance from financial aid advisors or campus resources can help students make informed decisions regarding their financial future.

Texas title loans for college students can provide short-term financial relief, but understanding consumer rights is crucial. Knowing your protections and navigating challenges thoughtfully will help ensure a positive outcome. By staying informed and taking proactive measures, college students can make informed decisions regarding Texas title loan agreements.